Gone are the days when people could be stuck in their businesses because of financial constraints. Mobile banking has now made things easier that we can access loans directly from our phones. Through loan apps, you can now access loans without stressing yourself about guarantors. Besides, some of the best loan apps in Kenya allow you to save money with them and qualify for higher loans.

READ ALSO: Deposit money to your Cooperative Bank account via Mpesa

Loan apps are now helping banks run their money, unlike in the past days when one had to go to the bank to process a loan. Have you been thinking about the best mobile moneylenders in Kenya?

10 best loan apps in Kenya today

Getting a loan from one of the best loan apps is now faster and easier. Discover the best money lending apps in Kenya now.

1. Tala loan app

Tala is among the best loan apps to Mpesa. To access this loan, you need to go to the Google play store, download the app, and sign up with your correct details to verify your account. Tala provides loans based on your digital credit history of which you can repay within 21 or 30 days.

Tala interest rates depend on the loan duration; 21-day loan interest ranges from 5 to 14%, while a 30-day loan interest ranges between 7 to 19%. You can repay the loan using Mpesa Xpress or Tala pay bill number, 851900. Remember that you can make partial payments as long as your loan does not exceed the repaying period.

2. KCB Mpesa

Have you been wondering about where to save your money and qualify for higher loans? KCB Mpesa is mobile moneylenders owned by the Kenya Commercial Bank to enable customers to save and take loans. They offer loans from a minimum limit of Ksh.50 to a maximum limit of Ksh. 100,000 with an interest rate of 7.5% per month.

You need to have a Safaricom sim card for you to activate the KCB Mpesa loan account. Interestingly, KCB Mpesa has a top-up feature that allows you to take loans more than once as long as you do not exceed your loan limit.

3. Mshwari by Safaricom

Owned by Safaricom, Mshwari is one of the best mobile services that offer quick loans. To access Mshwari, you need to have a Safaricom line, go to Mpesa Menu, and activate it. Mshwari not only allows you to save but also take loans from a minimum amount of Ks.100.

Mshwari gives a 30-day loan duration with an interest rate of 7.5% per month. Besides, saving with Mshwari will earn you an interest of 6.65% per annum. Remember that the more you save and repay loans on time, the more eligible you become for higher loans.

4. Branch loan app

This is one of the best loan apps in Kenya with low-interest rates. To access a loan, go to Google play store, download the branch app, and follow the given steps to register. It offers a loan of between Ksh. 250 to 70,000 with a repayment duration of 4 to 48 weeks.

Interestingly, most people in Kenya and outside the country prefer this app because it does not charge late fees or rollover fees. You can repay your loan via Mpesa using the branch paybill number 998608.

READ ALSO: Top 10 Most Marketable Diploma Courses to Study in Kenya 2023

5. Berry loan app

To apply for a loan, you need to go to the Google play store, download the Berry app, and follow the simple steps to register. After you are verified, you will apply for a loan and wait for their response.

Berry offers loans of up to Ksh. 50,000, with an interest rate of 9 to 16%. Remember that the first loan you take with Berry cannot exceed Ksh.500.

6. Timiza from Barclays bank

Timiza is an app by the Barclays bank that allows customers to save and take loans directly from their phones. To access the loan, go to Google play store, download the Timiza app, and follow the given steps to register.

Those without smartphones are not left out as well; they can dial *848# on their phones to register. To qualify for higher loans, you can deposit money to the app through Mpesa.

7. Zenka app loan

If you have not tried Zenka, then it is time to try it. Zenka offers the first loans free with no interest charges (you repay the exact amount you borrowed). It gives loans from Ksh.500 to 30,000 with a repaying duration of 61 days. To apply for this loan, download the Zenka app, install it, register, and fill the form for loans. Paying loans on time will grow your loan limit.

8. iPesa app

Have you been looking for mobile moneylenders who can give you enough time to repay their loans? Not anymore because iPesa is here for you. iPesa offers loans of Ksh. 500 to 50,000 repayable between 91 to 180 days. They charge an interest rate of up to 12% with no service fee. To access a loan with them, download the iPesa app and register now.

READ ALSO: All you need to know about Hustler Fund loan

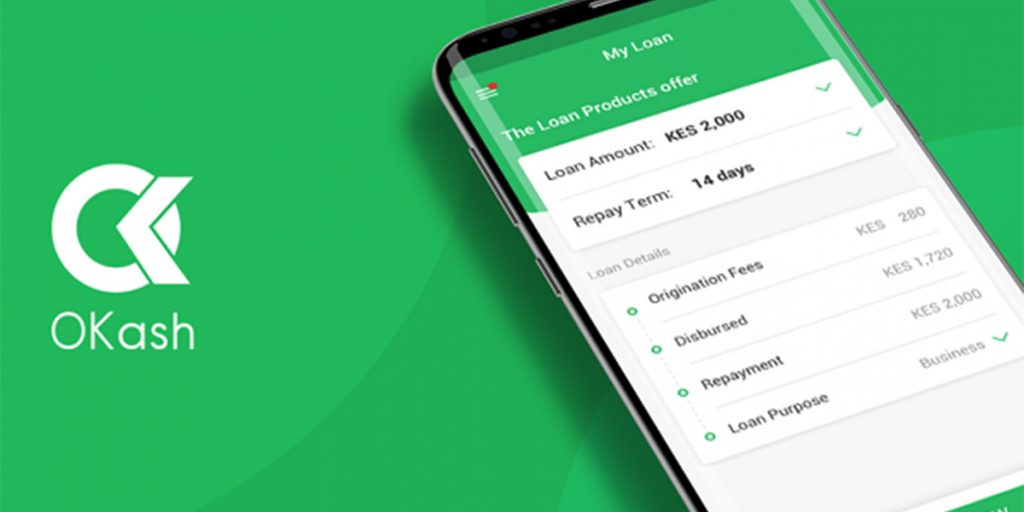

9. Okash loan app

This is among the best loan apps in Kenya without registration fee. It offers both personal and business loans of up to Ksh. 60,000. To qualify for Okash loan, you need to download Okash app, install it, and register. Be aware that their loan duration takes 15 days with a slightly higher interest rate of 14%.

10. Zidisha app

Zidisha is one of the best apps for instant loans that run more like an independent lender than an organization. To qualify for a Zidisha loan, you need to have a Safaricom line, an active Facebook account, provide your national ID, and be employed or running an active business.

You can repay your loan through Zidisha paybill account number, 600201. Do not forget that Zidisha offers loans based on your credit history.

Getting a loan from one of the best loan apps in Kenya will enable you to expand your business and develop more. Always consider taking enough time before you make any financial decisions.

READ ALSO: Activate KCB mobile banking and enjoy its services now

DISCLAIMER: Taking a loan from any of the above apps is a personal choice, and you should not entirely rely on this article to make your financial decisions. Therefore, any decision you make is strictly at your risk and responsibility.

READ ALSO:

- KCB mobiGrow account mobile banking

- List of the Best Banks in Kenya for Savings

- 15+ best Saccos in Kenya with good saving plans and investments

I am an actress at Ndizi Tv and fun fair writer at Kenyan Moves News and Media Website.