The Kenya Revenue Authority (KRA) plays a crucial role in collecting and managing tax revenues in Kenya. Whether you are an individual or a business entity with a Personal Identification Number (PIN) issued by the KRA, it is mandatory to file tax returns. This article provides a comprehensive guide on how to file KRA NIL returns online through the KRA iTax portal.

However, there are instances when you may not have generated any income during a particular tax period, and in such cases, you must file NIL returns to comply with tax regulations.

Why File NIL Returns?

Filing NIL returns is essential for individuals and businesses with a valid KRA PIN but not earning any income during a specific financial year.

It is a way to inform the KRA that you have not generated any taxable income from your sources. Failing to file NIL returns can result in penalties imposed by the Kenya Revenue Authority. To avoid such penalties, it is crucial to understand the process and use the KRA iTax portal efficiently.

Requirements for Filing NIL Returns

Before you begin the process of filing NIL returns, make sure you have the following requirements:

1. KRA PIN (Kenya Revenue Authority Personal Identification Number): You must have a valid KRA PIN to log in to the iTax portal. If you do not have a PIN, you can register for one on the iTax portal.

2. iTax Password: During the KRA PIN registration process, you will receive an iTax password via email. Ensure that you remember or safely store this password. If you forget it, there is an option to reset it on the portal.

How to file KRA NIL returns online

Filing NIL returns online is a straightforward process that can be done from the comfort of your home using a phone, laptop, or desktop computer.

- READ ALSO: Amber Ray biography; age, real name, tribe, family, education, husband, son, house, cars, net worth

Here is a step-by-step guide:

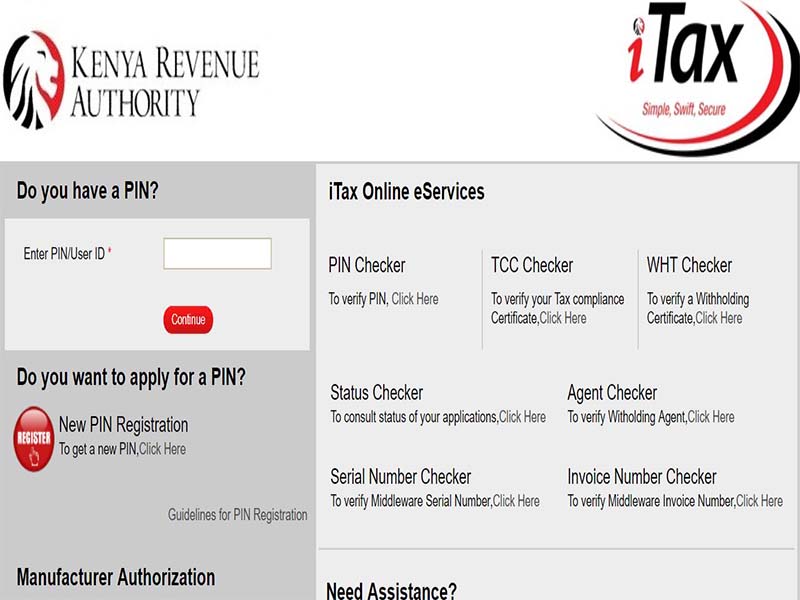

- Access the iTax Portal: Visit the KRA iTax portal directly by going to itax.kra.go.ke

- Log in: Enter your iTax password and answer the numerical security stamp question. Then click on the “Log in” button.If you forget your password, click on “Forgot password” on the login page. You will receive a password recovery link via email along with a KRA PIN reset guide.

- Select File NIL Returns: Once logged in, navigate to the “Returns” section and choose “File NIL returns” from the drop-down menu.

- Fill in the Required Sections: In the “Type” section, select “Self” to indicate that you are filing on your behalf. Your KRA PIN will be automatically filled in. In the “Tax Obligation” section, choose “Income Tax – Resident.” Click “Next” to proceed.

- Confirmation and Receipt: After completing the necessary sections, you will receive a confirmation message on the portal, and a receipt for your NIL returns will be sent to your email. Keeping these receipts as proof of filing your KRA returns online is essential.

Filing NIL Returns Using a Mobile App

If you prefer to file NIL returns using your smartphone, you can download the iTax mobile app, which streamlines the process.

Here are the steps.

- Download the iTax Mobile App: Download and install the iTax mobile app on your smartphone.

- Log In: Enter your KRA PIN and iTax password, then click on the “File Nil Returns” button within the app.

Filing NIL returns is a crucial obligation for individuals and businesses in Kenya with a KRA PIN. It is necessary to adhere to the deadline, which is typically June 30 of the following year, to avoid penalties from the Kenya Revenue Authority.

By following the steps on how to file KRA NIL returns online, you can easily file your returns online through the KRA iTax portal or the mobile app and ensure compliance with tax regulations.